For years, humanoid robots have dominated headlines with their human-like designs and futuristic appeal. Yet, a quieter revolution is underway: non-humanoid robot startups are rapidly gaining traction across industries. These companies are building robots that prioritize function over form, delivering practical automation solutions that are transforming agriculture, logistics, healthcare, and consumer technology.

What Are Non‑Humanoid Robots?

Unlike robots designed explicitly to look or move like humans (humanoids), non‑humanoid robots are designed for specific applications and environments. Their form and capabilities vary widely depending on purpose:

-

Aerial drones for inspection, delivery, infrastructure maintenance

-

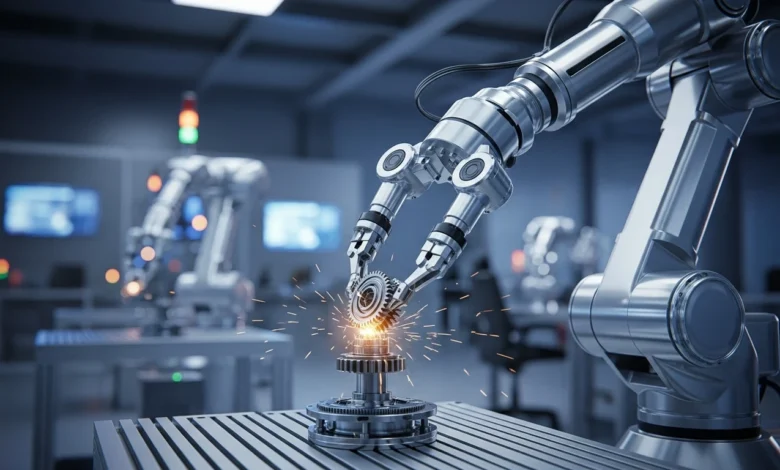

Robotic arms or manipulators for manufacturing, surgery or warehouse tasks

-

Quadruped or multi‑legged robots for navigating rough terrain or outdoor environments

-

Domestic robots (vacuum & mop bots, pool cleaning bots, smart floor‑care robots)

The advantage: they don’t try to replicate human appearance or full generality—they target doing one thing well. This allows simpler mechanical design, fewer constraints on interaction, faster deployment, and clearer ROI.

Why Are Startups in This Space Rising?

Several inter‑related factors explain the surge in non‑humanoid robotics startups:

1. Investor focus on utility & ROI

Recent industry data indicates that a large share of robotics investment is shifting towards “verticalised” robotics startups (those aimed at specific tasks/environments) rather than general‑purpose humanoids. For example, a Q3 2025 report shows global venture funding in AI & robotics surged 38% year‑over‑year, with non‑humanoid startups claiming a substantial share (beamstart.com; Crunchbase News).

Companies such as Infravision (aerial grid‑construction drones) raised US$91 million in Series B funding (businesswire.com; Crunchbase News).

And Narwal Robotics (home‑cleaning robot manufacturer) raised US$100 million led by Tencent & Beijing Robot Fund (South China Morning Post).

2. Lower development & deployment cost

Because these robots are task‑specific, they often avoid the mechanical complexity, balance/stability challenges, and user‑interaction overhead of humanoid robots. This can mean faster prototyping, quicker commercial roll‑out, and earlier revenue.

3. Faster path to commercialisation

Non‑humanoid robots can often be deployed in controlled, industrial or semi‑structured environments (warehouses, farms, infrastructure) rather than the open‑world human environments humanoids must tackle. That means fewer unknowns, fewer safety/interaction risks, and clearer value proposition.

4. AI integration & sensing advances

Advances in machine learning, computer vision, lidar/SLAM, autonomous navigation, robotics control software mean that effective automation no longer requires a human‑form robot to perform many tasks. Robots can sense, plan and execute specialized functions without mimicking human limbs or gait.

What is an example of a non-humanoid robot?

Below are key players in non-humanoid robotics:

| Company | Focus Area | Funding |

|---|---|---|

| Infravision (Austin, TX, USA) | Aerial robotics for high‑voltage power‑line stringing & grid infrastructure | Infravision Raises $91 Million Series B Led by GIC to Revolutionize Power Infrastructure Construction with Aerial Robotics. |

| Narwal Robotics (Shenzhen, China) | AI-powered home-cleaning robots | Raised $100 Million at $2.4 Billion Valuation, Investors Include Tencent & Beijing Robot Industry Development Investment Fund. caproasia.com |

| DJI (Shenzhen, China) | Aerial drones for agriculture, inspection, filming | Global leader in drones; widely adopted in multiple industries. en.wikipedia.org |

| Agrobot (Spain) | Farming robots: Strawberry Aid Harvester | agrobot.com |

Applications Across Industries:

Non‑humanoid robots are reshaping multiple sectors. Here are key application domains:

-

Agriculture: Autonomous harvesters, soil‑sensors, crop‑monitoring drones that traverse fields and orchards with minimal human intervention.

-

Logistics & warehousing: Robots that sort, pack, pick, move goods—tasks previously done by humans in structured environments.

-

Infrastructure & utilities: Drones and ground robots that inspect, repair and string power lines, bridges, pipelines, etc.—as illustrated by Infravision’s use case.

-

Healthcare & service‑automation: Robotic manipulators for surgery, rehabilitation devices, home‑care bots (though some may verge on humanoid form).

-

Consumer tech / smart home: Home‑cleaning robots, lawn‑mowing bots, pool‑cleaners and smart floor‑care robots like Narwal.

Because these robots focus on doing specific work well, they often deliver measurable productivity gains, cost‑reductions, and faster ROI.

Future Outlook:

Looking ahead, the rise of non‑humanoid robotics suggests several trends and caveats:

Predictions & positive signals:

-

The robotics investment boom is expected to continue, especially in task‑specific automation rather than general‑purpose humanoids.

-

As industries demand scalable, cost‑effective automation, non‑humanoid robots are well positioned to deliver.

- Wider deployment means more data, better AI models, improved reliability and lower unit cost over time.

Challenges & caveats:

-

Regulatory & safety issues: Deployment of autonomous robots (especially outdoor, aerial or infrastructure‑related) involves regulatory approvals, airspace considerations, safety certifications.

-

Workforce displacement concerns: As automation proliferates, traditional labour roles may shrink—raising social and ethical questions.

-

Over‑hyping vs realism: Even non‑humanoid robots face engineering, perception and deployment hurdles; marketing can sometimes oversell.

-

Integration & ecosystem readiness: Robots don’t operate in isolation—they need supporting infrastructure (connectivity, power, maintenance, data). If that’s missing, deployment falters.

- Human‑robot interaction complexity: Even non‑humanoid robots in human environments (homes, service settings) need robust sensing, safe navigation and UX; mistakes can harm brand/trust.

The rise of non-humanoid robot startups signals a shift in robotics innovation. While humanoid robots capture imagination, non-humanoid robots dominate practicality. Their growth is expected to accelerate as industries demand scalable, cost-effective automation.