Business ownership is the legal and operational control of a business entity. It involves managing resources, making strategic decisions, bearing financial risks, and ensuring compliance with laws. Ownership can take the form of sole proprietorship, partnership, corporation, or limited liability company (LLC).

Business ownership is the cornerstone of entrepreneurship. It defines who controls a company, who bears its risks, and who enjoys its rewards. As Investopedia explains, ownership is not just about holding shares—it is about accountability, governance, and long-term vision. From small family shops to multinational corporations, ownership structures shape economies and societies.

What Is Business Ownership?

Business ownership refers to the legal authority and responsibility over a business entity. Owners are tasked with:

-

Managing operations

-

Bearing financial risks

-

Ensuring compliance with regulations

-

Driving growth and innovation

Key NLP-rich entities: equity, liability, governance, taxation, compliance, shareholders, entrepreneurs, partnerships.

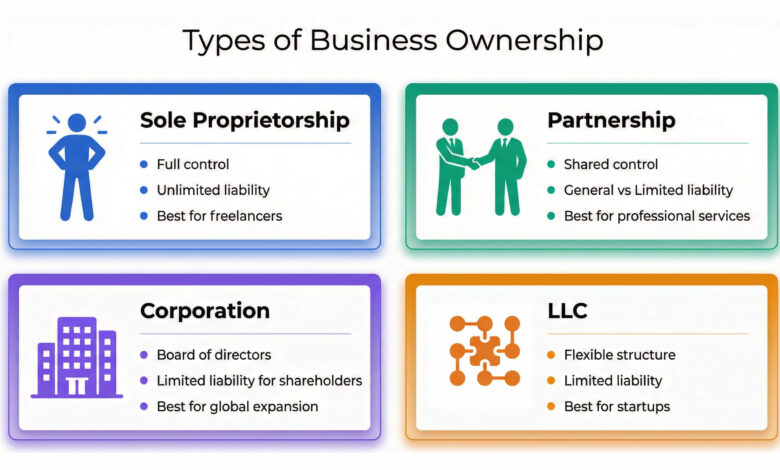

Types of Business Ownership

1. Sole Proprietorship

-

Owned by one person

-

Offers full control but exposes the owner to unlimited liability

-

SBA notes this is the most common structure for small businesses in the U.S.

Case Study: A local bakery run by a single entrepreneur. The owner makes all decisions but also bears all debts.

2. Partnership

-

Two or more individuals share ownership

-

Can be general (equal responsibility) or limited (restricted liability)

-

HubSpot highlights partnerships as effective in law firms and consulting agencies

Case Study: A medical clinic co-owned by two doctors, sharing profits and responsibilities.

3. Corporation

-

A separate legal entity

-

Owners are shareholders with limited liability

- Forbes emphasizes corporations as scalable structures for global expansion

4. Limited Liability Company (LLC)

-

Hybrid structure combining flexibility of partnerships with liability protection of corporations

-

Investopedia notes LLCs are popular among startups

Case Study: A tech startup registered as an LLC to attract investors while protecting founders from personal liability.

| Ownership Type | Control & Decision-Making | Liability | Taxation | Best For | Example Case Study |

|---|---|---|---|---|---|

| Sole Proprietorship | Full control by one owner | Unlimited personal liability | Income taxed as personal income | Small businesses, freelancers | Local bakery owned by one person |

| Partnership | Shared among partners | General: unlimited; Limited: restricted | Income passes through to partners | Professional services (law, consulting) | Medical clinic co-owned by two doctors |

| Corporation | Board of directors & executives | Limited liability for shareholders | Double taxation (corporate + dividends) | Large-scale enterprises, global expansion | |

| LLC (Limited Liability Company) | Flexible (members or managers) | Limited liability | Pass-through taxation (default) or corporate taxation | Startups, SMEs seeking flexibility | Tech startup registered as LLC |

Responsibilities of Business Owners

Owning a business is not just a privilege—it is a responsibility:

-

Strategic Decision-Making: defining vision, mission, and growth

-

Financial Management: handling capital, revenue, and taxes

-

Legal Compliance: licenses, regulations, labor laws

-

Risk Management: insurance, liability protection

-

Human Resources: hiring, culture, leadership

As IMF research shows, ownership structures directly influence economic resilience and entrepreneurial ecosystems.

Benefits of Business Ownership

-

Autonomy: freedom to make decisions

-

Wealth Creation: potential for profit and equity growth

-

Legacy Building: passing businesses to future generations

- Innovation: ability to shape industries

Challenges of Business Ownership

-

Financial Risk: debt, investment uncertainty

-

Regulatory Complexity: compliance with laws and taxes

-

Market Competition: staying relevant in dynamic industries

-

Human Capital: managing employees and culture

Forbes stresses that balancing freedom with responsibility is the hallmark of successful ownership.

🔹 FAQs :

-

What is the difference between ownership and management?

Ownership is about legal rights; management is about day-to-day operations.

-

Can a business have multiple owners?

Yes, through partnerships or corporations with shareholders.

-

Which ownership type is best for startups?

LLCs are often preferred for flexibility and liability protection.

-

How does liability differ across ownership types?

Sole proprietors face unlimited liability, while corporations and LLCs offer limited liability.

Business ownership is the foundation of entrepreneurship and economic growth. Whether through sole proprietorship, partnership, corporation, or LLC, the choice of ownership structure shapes not only the company’s future but also the owner’s responsibilities and opportunities.